Nisab is the minimum amount that a Muslim must have before they are required to pay Zakat.

Traditionally, the two values used to calculate the Nisab threshold for Zakat are gold and silver. This threshold was set by Prophet Muhammad (ﷺ) at a rate equivalent to 85 grams of gold and 595 grams of silver (or 87.48 grams of gold and 612.36 grams of silver according to another opinion).

As we no longer use silver or gold as currency, you need to find out the equivalent monetary exchange value of the rates the Prophet Muhammad (ﷺ) set in your local currency. You can do this by checking the market rate of gold and silver.

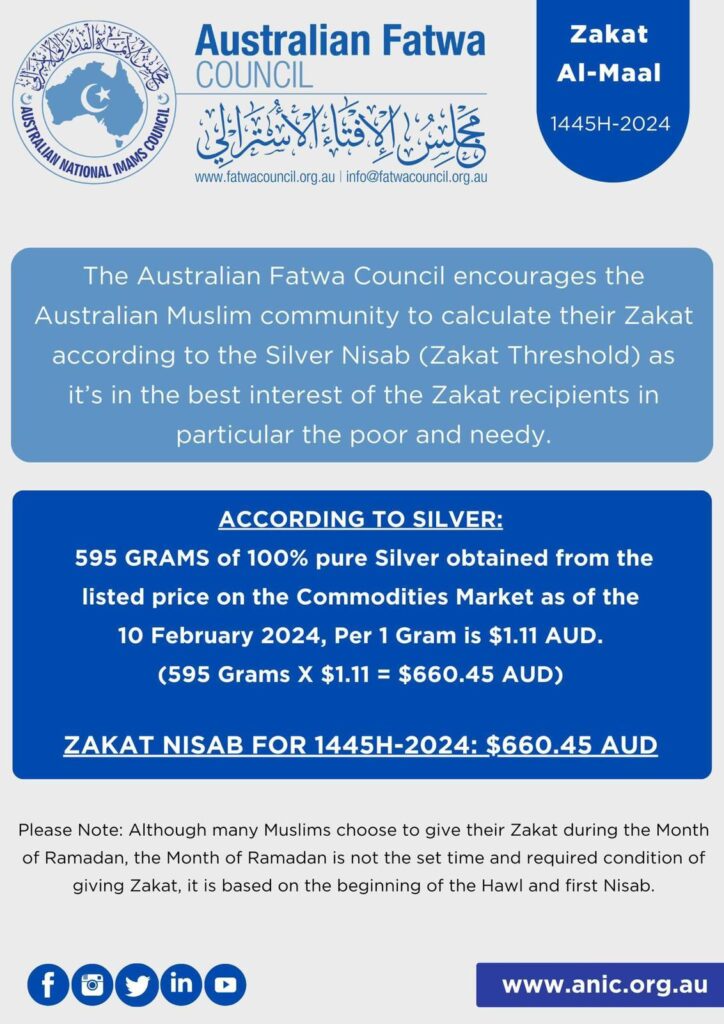

In most cases, scholars will recommend using the value of silver to calculate the Zakat you as it is in the best interests of the Zakat recipients, particularly the poor and needy.

In 2024, the value of silver is $1.11 (AUD) per gram. When using the opinion of 609 grams of silver for Nisab, the Nisab threshold is approximately $675.99. For 595 grams of silver, it is $660.45 (AUD). This is the amount set by ANIC for 2024.

In the Hanafi madhab, the value of silver is used to ascertain the Nisab threshold and eligibility to pay Zakat. The other madhabs use the value of gold.

Islamic Relief advises its donors to use the silver value (which is almost always a lower threshold to gold) because this allows for a greater amount to be eligible for Zakat, which means more help for deserving Zakat recipients.

In explanations of Zakat, you may hear the term ‘Hawl’ – which means a lunar year. Therefore, a hawl (lunar year) is 354 days long.

You should make your zakat payment one Hawl (lunar year) after you become eligible to pay Zakat. However, this is only if your wealth on that date is still at – or above – the Nisab threshold and has been so throughout the Hawl.

Nisab is the minimum amount that a Muslim must have before being obliged to zakat. It is based on the valuation of 595 grams of silver.

The Nisab value is what an individual must have before they are required to pay zakat. An individual can calculate this based on the value of gold or silver that they have. However, by using the silver value, it means that more people are likely to be eligible for Zakat, which means more money benefiting the poor and needy.

If this amount is more than the value of the current Nisab value (595 grams of silver), and you have also met all other requirements then you will need to pay Zakat on this.